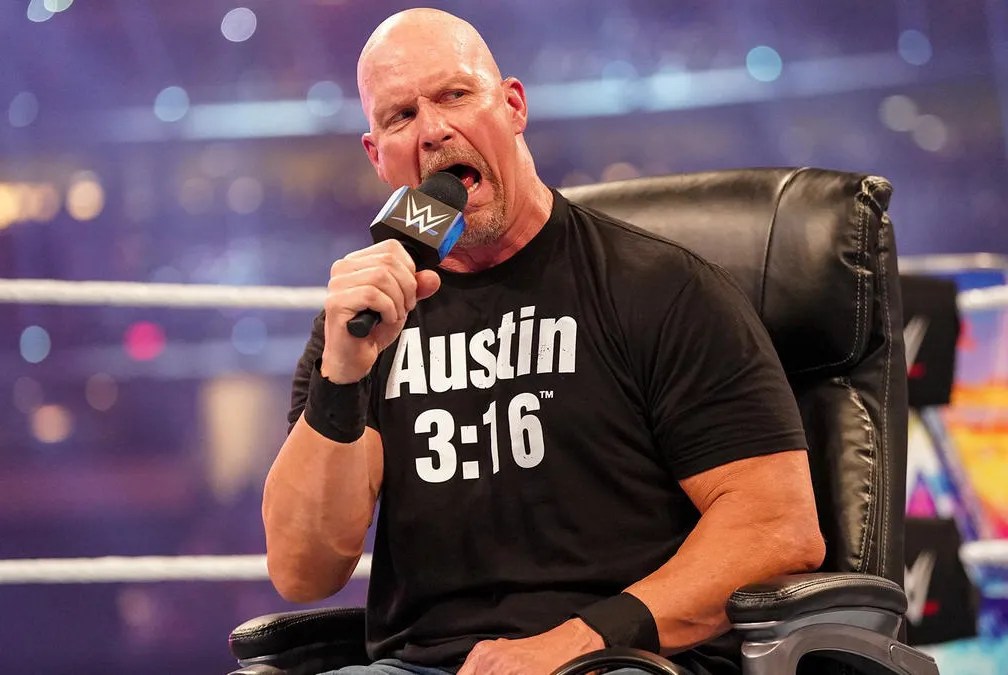

I’m a big wrestling fan. Stone Cold Steve Austin was one of my favorites. Part of his catch phrase was meant to drive home that he had the final word over his opponent. “The bottom line” didn’t mean what it actually means but it’s probably something we’ve adopted to have the final word too.

I could talk about wrestling until the cows came home but thats for another blog at another time. The bottom line I’m referring to is yours. You were well funded right up until you lost your job. You have severance if you’re lucky but the money will run out. What you do now is up to you.

When you find out you’ve lost your job, you should file an unemployment claim immediately. Why? Because if you have severance, vacation or COBRA payouts, that all gets factored in to when your claim starts. Because of the residual money from your employer, you’ll be initially ineligible for benefits. If you got paid all at once consider yourself lucky. If you’ll get severance payouts for a few months, the claim is in place for when those stop. In most cases, even when you pass the point of ineligibility, you may have to wait a few weeks before the funds start dropping in. The most important thing to remember about unemployment is that you’ll pay taxes on it and it has a limit in most cases. Unemployment can slow the bleeding but it won’t stop the bleeding. A job will. Get it in right away and you’ll panic less later.

Another thing you need to ask yourself is how much savings you have. If you have savings and it’s considerable, its okay to panic less while still aggressively looking for work. If you don’t have any, its not yet the end of the world. Do you have a 401k from your last employer? While there may be a penalty, you can borrow against it and your 401k handlers can tell you how. Do you have collateral? Maybe you’ve paid off your car or even your house. If you have something paid off that is of considerable worth, take a loan on its value. Yes, you will need to start making payments back on that loan but you still have padding to pay your bills. Remember that you only need to use it until you find a job. Past that, you can put back what you didn’t use and pay off what you borrowed. You may even find that as soon as you get the loan, you’ve found a job. Put it back and you’re free and clear.

Let’s say you find a new job. Involuntary job loss is increasing and so you practically need an insurance policy in case you find that you’ve bet on the wrong horse (because that’s what it may feel like now when you land a job). Consider putting most of your savings away every month. Consider that you need one years income in case the layoff chances go up. It could be that you bet on the right horse and you can ride this job right on into your retirement. Don’t bet on that anymore. It could be that you have a fundamental disagreement with your employer and they fire you. You don’t get unemployment for being fired. You have your savings. You may find that with your savings (and a discussion with your spouse) you want to start working for yourself or you want a year off and you’ve decided to quit your job. You have your savings.

The bottom line is that you have a bottom line. Remember that the company you worked for eliminated your position because they didn’t have it in their bottom line to keep paying you. Consequentially it’s a chain reaction when you get laid off or fired. They have to cut back which forces you to cut back. Layoffs don’t mean defeat but they do mean that as part of organizing your next opportunity you’re safeguarding that bottom line and so you don’t lose the things you worked so hard for. There may be countries that take care of people when they get laid off. If you’re in the U.S., you don’t live in one of those countries.

Lastly is the very last option you should consider because you should try very hard to hold yourself up as best you can. Family. I know that this gets tricky because depending on the kind of family you have, they may never let you hear the end of it if you had to go to them for help. That being said, if you have family willing to help, let them. Remember. Its only temporary. You’ll get back up on your feet and you’ll pay them back. Make sure you’ve exhausted every resource, worked with every person or company you have to pay before you go to family. No job loss is worth risking a relationship with them if you can help it.

This is a tough time and you will get through it. Just remember that you’ve also learned from the experience when you come out the other side of it.

Leave a comment